Four former executives of a Missouri nonprofit netted $4 million each through a deal in which the nonprofit paid more than $47 million to a publicly traded company over 10 years, records show.

One of the four, Keith Noble, pleaded guilty Tuesday to a federal charge of not reporting a felony. Noble was chief clinical officer of Alternative Opportunities, which provided mental-health, substance-abuse and other taxpayer-funded services in several states, including Arkansas. Noble also was a member of the nonprofit's "Resource Team."

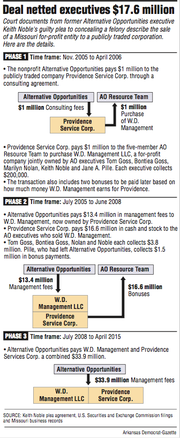

Noble's plea agreement includes accusations that unnamed colleagues stole, embezzled and misapplied more than $30 million. Among the claims addressed in court documents is the $17 million-plus sale of the nonprofit's management company, or "Entity A," to a publicly traded corporation, or "Company A."

Records filed with the U.S. Securities and Exchange Commission show the description of Company A matches Providence Service Corp., a Stamford, Conn., holding company, and Entity A is W.D. Management LLC, which was jointly owned by Noble and four other Alternative Opportunities executives, known as the "Resource Team."

Alternative Opportunities executives who sold W.D. Management were Tom Goss, chief financial officer; Bontiea Goss, chief administrative officer; Marilyn Nolan, chief executive officer; and Jane A. Pille, according to the SEC filing.

Before the sale -- for $1 million upfront and roughly $16 million in later bonuses -- Alternative Opportunities paid Providence $1 million through a consulting agreement, according to court documents.

Chris Plumlee, Tom Goss' attorney, and Melanie Morgan, who represents Bontiea Goss, said in a joint statement that the Gosses "acted appropriately" with regard to the W.D. Management transactions.

"The sale of WD Management to Providence was approved by the AO Board of Directors and has been separately been examined by independent auditors," the statement says. "In addition, Providence was a publicly traded company during the relevant time periods, subject to SEC oversight and public filings."

No other Resource Team members have been charged with crimes, though Tom Goss, Bontiea Goss and Nolan have been implicated in a series of accusations involving misuse of the nonprofit's money in plea agreements investigators reached with Noble and others.

The accusations include paying excessive amounts for leased vehicles to a company owned by top nonprofit executives; lending money at zero interest to for-profit companies owned by the executives; and spending millions on undisclosed lobbying and political advocacy activities, including bribing public officials.

Tom and Bontiea Goss' attorneys said Noble never raised any questions about the legality of their business decisions.

"Keith Noble was part of the resource team with Tom Goss and Bontiea Goss for many years, and at no time did he suggest or bring to their attention that he believed business decisions that were made -- often with the assistance and advice of experts in their field and others in the industry -- ran afoul of the law," the statement says.

"The accusations that Tom Goss or Bontiea Goss acted contrary to the interests of the healthcare organization that they helped found and which under their leadership provided award-winning services to thousands of people are simply false."

Court documents list "Person #15" as the fifth member of the Resource Team who benefited from the W.D. Management sale. "Person 15" left Alternative Opportunities at the time of the management company's sale and collected less money from the transaction than other executives, prosecutors wrote in the charge filed against Noble.

Pille, who has not been accused of wrongdoing, declined to comment when reached by phone.

Noble, through his guilty plea, became the first top-level Alternative Opportunities executive charged or convicted in the yearslong federal investigation.

The nonprofit in 2015 merged with Kirksville, Mo.-based Preferred Family Healthcare,another nonprofit. The Preferred Family name survived, but top executives from Springfield-based Alternative Opportunities took similar roles at the combined company.

The federal investigation previously resulted in guilty pleas from David Hayes, the nonprofit's former accountant; Milton "Rusty" Cranford, who worked as an officer over the nonprofit's Arkansas operations and as its lobbyist; former state Rep. Eddie Cooper, D-Melbourne, who also worked for the charity; and political consultant D.A. Jones.

Including Cooper, six former Arkansas lawmakers since January 2017 have faced federal charges, some directly related to Alternative Opportunities.

Five, also including Cooper, have been convicted or have pleaded guilty to charges: Rep. Henry "Hank" Wilkins, D-Pine Bluff; Sen. Jon Woods, R-Springdale; Rep. Micah Neal, R-Springdale; and Sen. Jake Files, R-Fort Smith.

When Cranford pleaded guilty June 7 to paying bribes to public officials on behalf of the nonprofit, he implicated Sen. Jeremy Hutchinson, but the Little Rock Republican has not faced charges in connection to Alternative Opportunities.

Hutchinson was indicted last month on fraud charges and on counts of filing false tax returns in connection with his law practice and campaign-finance accounts. He resigned from the Senate and has said he will fight the charges.

Noble's plea revealed several new accusations involving Alternative Opportunities' executives, including the previously unreported deal involving Providence Service Corp.

Providence purchased W.D. Management in April 2006 for $1 million, plus two bonuses to be paid in 2007 and 2008 based on how much money the sold firm earned, according to a Securities and Exchange Commission filing.

Those bonuses totaled $7.3 million in 2007 and $8.9 million in 2008, according to later SEC filings.

The first bonus Providence paid the W.D. Management sellers was all cash, split five ways. The second "earn-out," a mixture of cash and stock, excluded "Person 15," who had left the company, according to the charge filed against Noble.

"Person #15" received $1.7 million in total from the sale, according to the filing. The other four executives -- Noble, Tom Goss (Person #1), Bontiea Goss (Person #2) and Nolan (Person #3) -- each took $3.97 million, it says.

Before the sale, Alternative Opportunities paid Providence $1 million through a five-month "consulting agreement," according to Noble's plea. Alternative Opportunities also engaged W.D. Management in a 10-year management contract that set its future fees at 15 percent of the nonprofit's total earnings each year.

Providence, whose chief officers have changed since the deal, did not respond to multiple requests for comment. Its former chief executive and chief financial officer, who now run UAVenture Capital Fund in Tucson, Ariz., did not respond to an email seeking comment.

Noble's plea labeled the management fees as "unnecessary and excessive." It also says Tom Goss and accountant Hayes "artificially" inflated the fees paid to W.D. Management to maximize the company's earnings so that the bonuses would be higher.

Goss rewarded Hayes through an agreement that gave him a cut of the second earn-out, the court document says. Hayes died last year, apparently from suicide, months after he pleaded guilty to federal charges of theft, wire fraud and filing false tax returns. Hayes' plea did not mention the Providence transaction.

After the second bonus payout, Alternative Opportunities amended its 15 percent flat rate agreement with W.D. Management to be 15 percent of the first $20 million in revenue, 10 percent of the next $10 million and 5 percent of revenue exceeding $30 million, according to court filings.

Alternative Opportunities' founder, Richard Babcock said in an interview last week that he left the nonprofit in 2002 over a dispute with his hand-picked Resource Team.

The nonprofit had typically paid roughly 6 percent of its income to a for-profit management company that provided services that included accounting, auditing and management of salary expenses, Babcock said. Babcock and other Alternative Opportunities executives jointly owned the management company, he said.

Because Alternative Opportunities was a "public charity," it was not subject to the same IRS self-dealing rules that a "private foundation" would face. Both are types of tax-exempt 501(c)3 organizations.

The distinction is that foundations typically draw their money from a far narrower pool of donors, while charities receive money from a broader group. The logic behind the rule is that more people pay attention to a charity's activities, Ben White, an Atlanta tax attorney, has said.

However, even public charities may not do business with related agencies if they are paying more than the going market rate for similar services offered by other agencies. So, essentially, if the market rate for management services is 6 percent of income, the nonprofit would be barred from paying 10 percent of income for such services.

In fiscal 2005, after Babcock had left and prior to the Providence deal, Alternative Opportunities paid $115,000 in management fees to a firm called BMHI LLC.

The acronym stands for Babcock Management Holding Inc. In 2005, Babcock was no longer listed on the for-profit company's registration documents. Instead, Tom Goss was the listed president and Pille was the secretary. Goss and Pille were joined by Nolan and Bontiea Goss as the listed directors.

One year later, in the fiscal year beginning July 2005, the management fees went to W.D. Management and totaled $1.6 million, climbing to $3.6 million the following year and $8.1 million the year after that. The nonprofit's total revenue in that span rose from $22.6 million to $56.6 million.

Alternative Opportunities paid fees to W.D. Management every year through fiscal 2014, according to its tax filing. The payments are disclosed as compensation to contractors and are categorized as management or administrative services. In fiscal 2015, it paid Providence Service Corp. $1.8 million for therapist licensing, training and education.

The nonprofit merged with Preferred Family in April 2015, or two months before fiscal 2015 closed.

W.D. Management later "ceased doing business," according to articles of termination filed with the Missouri secretary of state on Oct. 21, 2016.

Asked about the Providence sale, Preferred Family spokesman Reginald McElhannon in a statement said the transaction "predated any of our current executive leadership, and so our knowledge on the specifics of this is limited."

McElhannon last week said the Kirksville, Mo., nonprofit is cooperating with investigations involving "several former Alternative Opportunities (AO) leaders and employees."

Preferred Family, which operates in five states, is selling its network of mental-health and substance-abuse clinics in Arkansas to Quapaw House Inc. of Hot Springs, a decision made after the state suspended it from receiving payments from Medicaid.*

"We have been aware that additional actions by government authorities were likely and are continuing to support efforts to hold accountable those who violated the law," McElhannon said.

SundayMonday on 09/16/2018

*CORRECTION: Preferred Family Healthcare, based in Missouri, has been suspended from receiving payment from Medicaid. A previous version of this article inaccurately described the sanction.